Why oil costs over $120 per barrel

Posted by Euan Mearns on May 30, 2008 - 9:44am in The Oil Drum: Europe

(New readers, click "there's more" below for the whole article...)

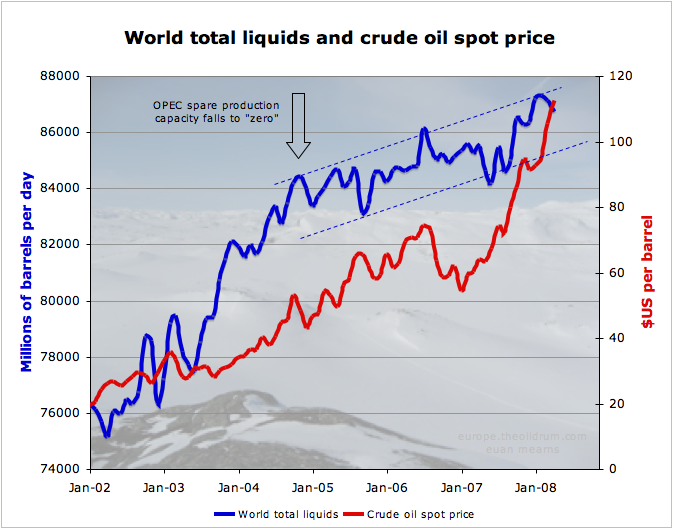

Global Total Liquids production and oil price, January 2002 to present. Production data from the IEA, data files supplied by Rembrandt Koppelaar. Monthly average WTI oil prices from Economagic.

With oil reaching $135 / barrel, Oil Drum readership exceeding 30,000 unique visitors per day and many wild stories circulating in the MSM as to why oil prices are so high this post strives to explain why oil prices are rising exponentially:

• Supply and demand

• Decline of older fields

• Declining net energy and energy density

• New mega-projects

• OPEC spare capacity

• Peak exports

Production and demand

The most significant feature of the chart up top is the dog leg in production growth in 2004. Prior to then the flow of new oil field projects combined with increasing utilisation of spare capacity allowed global oil production to grow and to meet much of the growth in demand.

In 2004, OPEC spare capacity fell close to zero (see below) and the world struggled for a number of reasons to bring on new supply to compensate for decline (see below). The slowing of production growth has meant new supplies are insufficient to meet growing demand and the price has gone up to balance the books. Higher prices stimulate conservation that may take the form of fuel efficiency (driving a smaller car) or abstinence (poor people being priced out of the energy market).

Every year a large number of new oil fields are brought on line. However, this does not directly translate to growth in supplies since amongst other things the production decline in existing fields needs to be replaced first:

new annual production capacity = consumption growth + annual decline + spare capacity growth

Decline

All oil wells, oil fields and oil provinces are exposed to a phenomenon called decline. Producing oil depressurises the sub-surface reservoirs and uses up the reserves. With time the proportion of water to oil that is produced in any well increases (increasing water cut) and this combined with depressurisation leads to declining oil flow rates.

Combined, these processes result in naturally declining production. It has been estimated that the global average decline rate is 4.5% per annum. (personal communication, Peter Jackson, CERA). What this means is that every year the global oil industry must bring on stream 3.8 million barrels per day new production just to compensate for decline (4.5% of 85 mmbpd). If less than 3.8 million bpd are commissioned then global oil production will fall and vice versa.

The higher global oil production rises, so rises the amount of new annual capacity required to compensate for decline.

As global oil production has risen, the annual new capacity required to offset decline has gone up too. Bearing in mind that all the best fields have already been produced, annual decline must be offset using second and third class oil fields. This task eventually becomes impossible and a production plateau is attained. That is where we are right now.

Net energy and energy density

The world has already used up a large proportion of its best oil reserves. These are the light sweet crude oil reserves produced on shore from first class reservoirs.

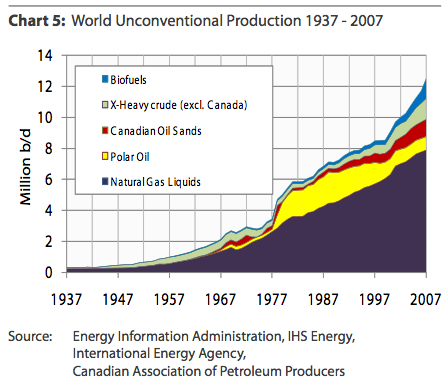

The proportion of low ERoEI liquids and low energy density liquids is growing exponentially. Source EIA and Oil Watch Monthly.

This chart shows that a growing proportion of world total liquid fuels production comprises second generation liquids - e.g. natural gas liquids, syncrude from tar sands and biofuels.. These are essentially synthetic liquids that need to be created and the process of creation uses energy. The term used to describe this concept is Energy Return on Energy Invested (ERoEI) and while historic oil production may have had large ERoEI numbers greater than 100, these synthetic liquids have low ERoEI. Around 1.2 in the case of temperate latitude ethanol and 5.0 in the case of syncrude produced from tar sand. The main point is that a steadily growing proportion of the global total liquids production is being used to produce these liquids leaving less for society to use than the bare figures may suggest.

ERoEI = (energy contained in fuel) / (energy used to produce fuel)

When the energy used to produce a fuel is larger than the fuel itself contains the ERoEI will be less than 1 and the whole exercise is rather pointless apart from in exceptional circumstances where energy quality is very important, e.g. in food production.

A second and equally serious issue lies in the energy density of the new liquids being produced. In energy terms, 1 barrel of ethanol or a barrel of liquefied natural gas is not the same as a barrel of crude oil. The latter contains significantly more energy. Hence measuring energy production by the volumes produced (barrels) is misleading and presents an over-optimistic picture.

As a rough approximation, the energy equivalence by volume of ethanol and LNG are as follows:

1 barrel of ethanol = 0.61 barrels of crude oil

1 barrel of LNG = 0.73 barrels of crude oil

In summary, the picture of rising liquids volume production up top is deceptive. With the passage of time the energy content of those liquids is falling steadily and the amount of energy used to produce them is rising. This means less energy for society to use at a higher cost.

31.8 billion barrels per year

The world now consumes 31.8 billion barrels of oil per year. 1978 was the last year that this volume of oil was discovered and more recently discovery has been running at less than 10 billion barrels per year. It is an utterly forlorn hope that exploration and new discoveries may alleviate the current supply crisis.

Mega projects

The inventory of past discoveries has not yet been used up and a list of new oil mega-projects first complied by Chris Skrebowski has been expanded and maintained by The OIl Drum in Wiki format.

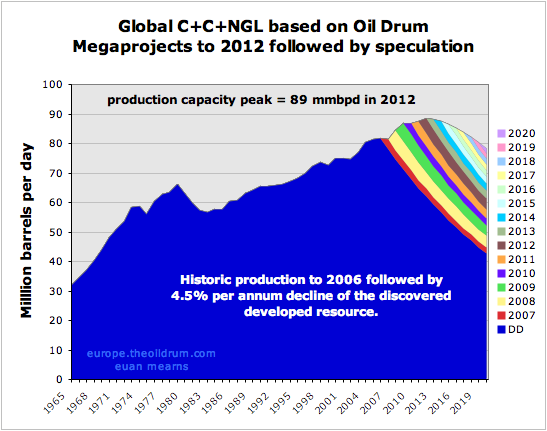

Global crude + condensate + NGL + syncrude scenario based on TOD mega-projects database as of 27 May 2008. This is not a definitive forecast since there is uncertainty over decline rate, project slippage and there is no allowance made for small projects. Beyond 2012 there is a planning horizon for projects and so beyond that date is pure speculation based on 10% per annum decline in new production capacity - and this may contribute to the apparent peak at that time. The 4.5% per annum decline rate is based on a personal communication with Peter Jackson (CERA) who conducted a comprehensive study of oil field decline last year. This decline is applied also to new production.

At face value, these mega-projects should be sufficient to ensure some production growth in the coming years.

However, the pattern of recent years has been project slippage owing to global shortages of materials, manpower and rampant oil service sector inflation. The pattern of slippage may continue and the promise of an increase in new supplies may remain just that – a promise.

Spare production capacity and OPEC

It is a feature of natural resource depletion that there is either a glut or a shortage. Managing this during the early years of resource exploitation causes all sorts of problems. On planet Earth we need to be thankful to OPEC for trying to manage this problem via their production-sharing cartel. For much of the period since OPEC formed in 1960, the world had excess productive capacity, i.e. production potential was higher than was utilised. Withholding this reserve capacity helped bolster prices and reduce demand. But with erratic additions of non-OPEC supply and a tendency for certain OPEC members to cheat on their quota, oil prices tended to swing in an unpredictable manner through the period 1960 to 2000.

Since 2000 this situation has changed. Global demand for oil has continued to increase and to meet this demand much of the OPEC spare capacity has been switched on so that all but Saudi Arabia are now producing flat out.

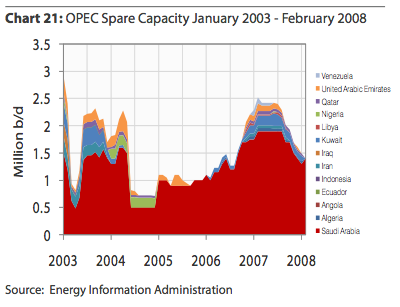

Global spare production capacity from this presentation by Lawrence Eagles of the IEA (link lost). Note how 8mmbpd spare capacity in 2002 had all but disappeared by 2004. It has since then grown slightly but is once again in decline.

This more detailed and up-to-date picture from Rembrandt Koppelaar's excellent May edition of oil watch monthly shows spare capacity in sharp decline. Despite a healthy inventory of mega-projects, the world is quite simply not managing to bring on new supply fast enough to compensate for decline.

In order to grow spare capacity, the world each year must commission new capacity to compensate for decline and to accommodate increased demand:

spare capacity growth = new annual production capacity - (annual decline + consumption growth)

As demand continues to rise against static supply, the only solution is for prices to rise and to price poor people out of the oil consuming economy.

Much of the spare capacity held in Saudi Arabia is heavy sour crude oil and the world currently lacks capacity in specialised refineries to handle this crude.

Peak exports

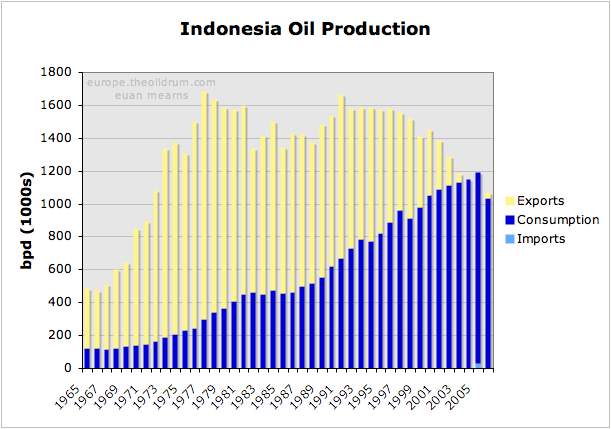

Another important concept is to consider is oil exports as described here by Westexas and Khebab. Oil exporting countries have increasing wealth and are attracting massive inward investment and migration resulting in steadily rising oil consumption. Indonesia provides a classic example of a former export land whose rising consumption has totally consumed their oil exports. Indonesia, once part of the oil supply solution has become part of the oil demand problem and has just left OPEC.

Rising demand and falling production has totally consumed Indonesia's oil exports in the space of 40 years. Indonesia's passion for bio-fuels is explained by this chart.

In 2006 Luis de Sousa produced this analysis of global oil exports. Those seeking an explanation for why oil now costs over $120 per barrel need look no further than this chart.

Luis de Sousa's analysis of net oil exports shows a peak in global oil exports in 2004/5 followed by a period of gradual decline until 2010. Net export decline then accelerates. If this analysis is correct then the current oil price / oil supply crisis will shortly get much worse. However, note that 4 important exporting countries - Iraq, Nigeria, Azebaijan and Kazakhstan - are not yet included in this analysis.

Oil is still cheap

At $2 per liter bottled spring water costs $318 per barrel.

Oil is still very cheap. Bottled spring water at $2 per litre works out at $318 per barrel. Oil is fundamental to our lives for transportation and a myriad products ranging from plastic to pesticides. Unlike spring water, oil is finite and costs significantly more to find and produce. The price of oil will continue to rise until the world as a whole decides it can do with less or until meaningful volumes of energy substitution take root.

Subsidies and taxation distort the market

Many of the world’s oil consumers do not pay the market price paid by the OECD. In Russia, the Middle East and China and many other countries oil and gasoline prices are subsidised. So the thirst of those consumers is not abated by current high spot price. Taxation in Europe and Japan also de-gears the impact of high oil price in those regions where high tax means that gasoline is already expensive. The impact of rising prices is felt less in these countries - though it is now beginning to bite.

Secondary factors and excuses

There are a range of secondary factors impacting the day to day fluctuations in oil price such as:

- Speculation

- Political unrest in producing countries

- The depreciation of the $US

- Prime exploration acreage that is off limits to OECD corporations

Speculation

Financial speculation in oil futures is being offered increasingly as the reason for high oil prices. True, speculation is rife. However, the futures market is a zero sum game. For every long position there is a short position and the price is ultimately struck by the individual who takes delivery of the oil - which is then refined and purchased by a consumer. For so long as consumers keep demanding oil at ever higher prices, the price will continue to rise.

The only way speculation could impact the oil price is under accumulation. Inventories of crude oil and refined products have been falling for a year (see figures 14 to 17).

Political unrest

True, political unrest in exporting countries such as Iraq and Nigeria means that less oil is being produced. But this situation has prevailed for many years now and is likely to get worse as energy poverty begins to bite.

The depreciation of the $US

True, the depreciation of the US$ has contributed to the rise in oil prices. But the oil price has risen in € too.

From Countdown to €100 oil by Jerome a Paris.

Off limits exploration

True, there are vast tracts of the USA that are under-explored in the ANWR and off the east and west coasts where the US has placed a high price on protecting their own environment. But it is not true that the Middle East and Russia are under-explored and that greater access to these areas by OECD companies would transform the current situation.

In summary these secondary factors touted by the MSM, politicians and oil companies are nothing more than an excuse and a distraction from the core problem which is demand growth running ahead of supply growth for over three years now. If the USA, Russia or Saudi Arabia could turn on the taps and produce an additional 3 mmbpd, the oil price would fall tomorrow. But they can't and the only way the oil price will come down is by reduced demand brought about by pricing poor people out of the energy market and by deepening recession.

Conclusion

We are now in the early stages of a full blown energy crisis that was predictable if not wholly avoidable. Politicians are awaking to the crisis now that escalating energy costs make its existence plain to see. It is highly unlikely that politicians will now grasp the gravity of the situation that the OECD and rest of the world faces and the responses will likely be ineffectual and too little too late.

The principal reason for current high oil price is the proximity of a peak in global oil production. Politicians must understand this and then grasp that natural gas and coal supplies will follow oil down by mid century. Reducing taxes on energy consumption right now is the wrong thing to do. Taxation structure needs to be adjusted to oblige energy producing companies to re-invest wind fall profits in alternative energy sources on a truly massive scale.

Energy efficiency should be the guiding beacon of all policy decisions and this must apply equally to energy production and energy consumption.

I wonder, will bottled water ever be cheaper than oil? How much oil is spent in piping and treating the water, bottling it and transporting it close to the consumer?

In terms of volume oil is by far the most traded commodity in the world today. What all those folks looking for scape goats need to understand is that 80 odd million barrels a day is really a big figure. Keeping that number for these last few years has been a tremendous task and a very special moment in Mankind's history.

Correct me if i'm wrong:

85 million barrels; 159 litres per barrel

Total litres = 13.5 billion litres

Estimated human population about 6.5 billion people.

Divinding 13.5 by 6.5 we have 2.07 litres produced per every human.

Meaning that if we'd passed the responssability to every human being in the planet of producing some kind of liquid that after some treatment could replace oil, every one had to produce daily 2 litres of such liquid.

I don't drink that much water per day.

MetaPico

You should drink 64 ounces of water everyday to keep your kidneys working fine and all the other running bady parts. If you don't then you are not Cycling your body like it should run.

But then again niether do I. But I am half camel, and I have had Kidney Stones, 3 times in the past 2 years.

Nothing we have can at this time equal the power production like OIL can, not water, not Urine, and not coca-cola..... So given the energy density of OIL, we better start making some life changes soon.

Charles.

2 litres a day! Even if I rendered down the wife, I figure that I'd only get about 13 litres of dripping. (Hmmm, I wonder though, maybe it would be worth it for one final week of driving pleasure!)

Desalination of seawater has a low energy consumption compared to the energy in oil.

This water could be bottled :-).

ca. 2003 stated price <8$/1000 Gallon

http://www.membranes-amta.org/media/pdf/desaltingcost.pdf

and approx the same here, where it is noted the importance of using updated energy costs.

http://cat.inist.fr/?aModele=afficheN&cpsidt=18585189

and a nice description from california on the kWh necessary for various techniques.

http://www.coastal.ca.gov/desalrpt/dchap1.html

kind regards/And1

for what it is worth

the 30+ billion plastic water bottles we bought in 2006 ...

Who is this we you speak of, Kemosabe?

So drink tapwater and dress in recycled paper coveralls that you can use as fuel every month or two when they become obnoxious for other folk to be around. Sheesh.

refer to the link for author and details.

Here in the uk I recently bought loads of Buxton water (best quality spring)in 1.5 litre bottles, from my local T*sh*tco and it cost 17p per litre, or 34p per litre at usual price. I have to conclude that the US dollar must be really worth 0.1 GB Pounds rather than the ~0.6 generally supposed.

The Bottled water issue is that 204 Dollars is a value added tax. I ran numbers for my Dad's Club soda per barrel, then took out the price on One barrel of Oil for the production costs of the One barrel of Club Soda.

I was really hit hard today when I went to Buy Eggs from Wally-World. Dang, I thought the prices were high a while ago.

I don't drive so I don't see the pennies flying out the door so much as I used to. I walked to the Local Wally-World this afternoon and again this evening from my 3rd Ex-wive's trailer and seeing that I either take a bus or walk everywhere I just notice that the Number of Cars seems to be there still and Wally-World was just as packed in. But I did notice the cost of Food going up and up.

"Food or Gas?" I was saying to anyone that could hear me while I walked the Isles in the local Wally-World....

Being recently disabled because of damage due from Blood Clots in 2005, I notice where my dollars go I am Glad I don't have to pay for a car too.

But sooner rather than Later and before the Election this is going to Blow up into a full blown crisis sooner than most MSM and Poli-tick-ians know.

Charles.

Bottled water is already much cheaper than oil. Just because water costs a buck a liter (or more) doesnt mean it costs $8 a gallon or $300 a barrel. Most of the cost of water is in the per unit price, and it doesnt scale linearly. If you were to buy a barrel of spring water, it would only cost you about $10-$30, depending on where you are. Most of that cost would be delivery.

In a sense, when you buy water, you are really buying oil. The oil it took to pump and package the water.

I get a flat of 35 1/2 liter bottles of water for $6 at Costco. What you pay for is convenience.

I lifted the price from this link here:

https://secure1.securewebexchange.com/aquamaestro.com/innerview.asp?cati...

One of the real issues here is the poor quality of water in our taps. In Aberdeen my wife and two kids refuse to drink the tap water which they claim is foul.

Bottled water wastes energy and produces so much waste.

The crude oil vs bottled water comparison argument is specious and getting annoying. If you're going to compare crude oil to water, don't compare it to bottled water but rather to tap water. Or better yet to the bulk cost of ocean or lake water. It is disingenuous to compare a processed and packaged product to a raw material.

A very good read. Does the graph showing the amounts of unconventional oil allow us to correct the all liquids graph for the lower energy values of the ethanol and natural gas liquids? This would allow us to see whether all liquids really is increasing? Just eye-balling the NGLs, it looks like all liquids should "really" be about 2 million bpd lower.

Peter.

|It is a quite concise intelligent and simple explanation of the problem... it is a good read.. like a lot of stuff at TOD

Is this stuff circulating by more direct lobbying means to the powers that be.

I see WT has MSM article lined up and all but what have "we" on the inside track. who do we have on the inside? anybody? Or is it just hit the media via osmosis?

Gordon Brown today was terrifyingly inept. I hope he was just posturing for public consumption but my take is he hasn't got a clue.

Not an out and out doomer but the current reactions are not confidence inspiring.

Boris

London

I think that a lot of journalists are Peak Oil aware, but the problem is the tiny--but slowly growing--number of Peak Oil aware journalists that are willing to write about it.

We need to keep in mind journalists can write only what editors allow. I've not heard a single comment about what the editors know or don't know or do or don't do.

Perhaps a more effective/efficient outreach might be to contact editors?

Cheers

can you embed in "write to them"?

Boris

London

Newspapers are businesses. The measly 1.50 they get to drive a Sunday paper to my remote location is nothing of what it takes to pay for it. Advertising is their source of revenue.

I think most editors would look at harping on PO as advertising revenue suicide.

When you really wrap your mind around this stuff, it is very scary, maybe the Mayans have it right "2012".

What sells? Sex, blood, violence... plenty of that could be coming soon!

Besides, this stuff is a bit addictive. Once they get their readers hooked on PO, they'll have 'em for life... though that may not be long...

He-he...

Cheers

"What sells? Sex, blood, violence... plenty of that could be coming soon!"

True!

"this stuff is a bit addictive"

Double Tripple true!!

I like your sense of humour, It will be needed.

Newspapers are businesses. The measly 1.50 they get to drive a Sunday paper to my remote location is nothing of what it takes to pay for it. Advertising is their source of revenue.

I think most editors would look at harping on PO as advertising revenue suicide.

When you really wrap your mind around this stuff, it is very scary, maybe the Mayans have it right "2012".

David Strahan has an article in today's Daily Telegraph, titled "sory Gordon but geology has us over a barrel". I think Gordon Brown may be waking up to reality as well. I think he has recently (very) been to Scotland to try and get North Sea oil production revived and may have been told some uncomfortable truths, though this is my cynicysm at work not necessarily factual!.

According to the same paper he is talking about tax concessions to help boost North Sea Investment. (words like "Horse shut bolted gate after" come to mind).

Which is a typical dud MSM headline for when you want to Pravdicate the issue. In contrast to, say, "We are now entering into an unprecedented and unending crisis". You'll never read that in any newspaper.

As for what our Prime Criminal says, it's traditional form for the government to blame natural forces for its woes. If the opposition were to start doing so too then that really would be a transformation.

Robin,

Point 1

Don't disagree with you, just pointed what was said. Headlines based on loose puns are just the name of the game i'm afraid, anoying as they may be.

Point 2

No problem here either. Infact to go further politicians will take credid for all things good, yet blame forces beyond their control for all things evil. We all know the UK's credit boom payed for the economic growth of the last decade, now, I fear its double bust for the next few to come. That's not Gordon's fault (sarcasm), it is the USA's!

point 3

Now you are asking for too much indeed!

Boris, from this side of the pond, Gordon looks like a blooming genius compared to the draft dodgers and congressional nitwits running this country. Absolutely superb and concise summary of the problem. Nothing most of us here at TOD don't already know but nonetheless a superb compilation of all relevant data distilled down to the basics. It is a classic monograph which will go into my "saved" folder.

I think I need to work with Rembrandt to see if we cannot come up with an energy density chart normalised , because I do suspect that the volume chart will at least be flattened in doing so.

This is a chart of liquids - shouldn't the analysis be of Liquids Returned on Liquids invested?

Aren't we dealing with the Oil/liquids crunch, not the energy crunch? E-ROI is certainly important for cost and long-term sustainability, but that's a different analysis. For instance, if we use coal (or natural gas, if you decide that NG isn't a liquid fuel) for ethanol distillation, then the Liquids Returned on Liquids invested is about 5:1.

I'm not sure it's fair to adjust the Liquids data for the low E-ROI of tar-sands and ethanol.

I'm not sugegsting adjusting for EROEI - though that would, I suspect be truely eye-opening - but for the fact that the energy contained in, say, 1 barrel of natural gas liquids is only 73% of the energy contained in a barrel of oil. So, it's not really counting apples and apples to add together crude oil barrels and NGL barrels,

Peter.

Russia and Saudi Arabia

Some other very important points. Russia seems to have reached a second production peak following recovery from collapse. Rising production in Russia since 2000 has helped global supplies a lot. This additional supply now going into reverse is a very serious problem.

And Saudi Arabia is struggling to raise production and / or spare capacity despite new mega projects suggesting that they too are fighting decline.

I am currently sworn to secrecy, but there will be a major MSM article coming out soon, hopefully this week, on net oil exports.

IMO, there is almost no chance that Saudi Arabia will, in 2008, match or exceed their 2005 annual production rate, which would mean three straight years of production below their 2005 rate, which leaves us looking toward 2009, while their consumption is increasing at a rapid clip, probably about +6%/year over the past five years, which has the predictable effect on net oil exports.

Westexas I was wondering if you would consider one valid change to export land.

Instead of consumption increasing forever in exporting countries we would expect it to level out at some consumption level. Lets say two or three times the level of consumption per capita in the US.

I played with it a bit and it does not make a huge difference but it does leave some countries with exports.

However we would expect the rate of growth to begin to decline as it hits these limits.

Given a population of 300 million for the US and a 25 mbd use rate we have .083 mbd/million people.

Saudi population is about 30 million so 2.49 mbd *3 = 7.47 mbd. So the max is probably between this or about 5mbd. This leaves about 2-3mbd or so of exports. Actually all other countries go to zero for the most part but we can expect the per-capita growth rate to slow as usage approaches and surpasses the per capita usage in the US. If Saudi Arabia stopped at levels similar to the US then they would have more exports.

Its actually done correctly here and I think some of your models have it presented correctly.

This paper has it right. And I did my rough one before I found this and its about right :)

http://graphoilogy.blogspot.com/2006/02/saudi-arabias-ability-to-export-...

The real kicker is people need to understand that simply having the people in the exporting countries increase their standard of living in line with what the US enjoys is sufficient to effectively stop world oil exports. I don't think a lot of people realize that oil exports actually require most countries to impoverish the citizens. Nigeria, Russia, Mexico etc none of these countries would have ever been oil exporters if the citizens enjoyed a standard of living close to ours. In effect the US was stealing the worlds oil and not compensating the citizens of these countries with a decent standard of living.

If the Saudis kick out the immigrant labor force, then the Saudi oil consumption will go down a little, and immigrant's home country's oil consumption will go down a lot. Ditto for the US and Europe.

If we have the choice of paying twice as much for the burger slinger at McDonalds, or walking to work...not to mention the immigrants in America aren't going to be happy about the dollar dropping against hard currencies like the Peso...

The energy usage of a country is a proxy for its population growth and rate of development. Population in KSA is rapidly exponential as the Graphoilogy site shows. The usage per capita is high but fairly constant at around 25.

Fig 4. is the kicker -even with lower growth rates NET exports still decline fairly rapidly. For a country further along the curve (higher % internal usage at time of peaking) the decline is even quicker as Jeff has repeatedly shown for Indonesia and UK... 7 or 8 years to 0...

Of course the whole point of the ELM is to show the negative effects that unconstrained internal energy usage in NET exporters can have on their exports but I believe this to be an unrealistic assumption

Even Chaiman Mow realised that unconstrained population growth was eventually going to bring the country to its knees -indeed his answer was even more draconian than anything that would be considered in the West.

How to incorporate in the model?

From here on out efficiency will be a key priority for the NET importers and that's pretty much where places like KSA get all their 'stuff' from. So I would add an efficiency 'fudge factor' going forward that eased the energy usage per capita downwards. For KSA it might go from say 25b/capita to the European average of ~12 at peak This would clearly enable a very good standard of living to be maintained and allow for the exporters having a sense of urgency in their energy usage policy...

[Another factor that is not being considered in the ELM is 'substitution'. For example what if KSA decides that, given $500/b oil it wants to go nuclear so that instead of simply burning oil it can export it? -I think this will have a really big effect on enabling exports to decline less dramatically, a 'substitution variable' would be needed but I have no idea how it would work...]

Regards, Nick.

I've previously suggested Phase One and Phase Two net export declines. In Phase One, the cash flow from export sales increases, even as volumes fall, because rising oil prices are offsetting the decline in volume. In Phase Two, rising oil prices can't offset the decline in volume. The transition from Phase One to Phase Two is probably where we would expect to see some lower rates of increase in consumption.

However, consider the ELM itself. I stipulated a 2.5%/year rate of increase in consumption (and a -5%/year production decline rate), which produced a peak export to zero export period of 9 years. If Export Land had a zero rate of increase in consumption, they would have gone to zero in 14 years, instead of 9, not a big difference.

It means they can continue to Export for about 50% longer...

It looks increasingly like the last 30+ years of US 'development' towards service economy, etc. is not a 'model' for 21st Century society but rather a by-product of the fact that they 'got there' first and where able to cream-off the lions share of NET global Oil/Energy...

Now that all the other economies are trying to emulate this 'transition' it will soon be shown for what it is: a fraud... The Economists are gonna love explaining this one to the seething masses...

Ooops!

Nick.

Unfortunately, Saudi Arabia is currently showing an accelerating rate of increase in consumption, up close to 10%/year over the original EIA estimated for 2006 (since revised upward), so that consumption is up at over +7%/year from the revised number, a five year rate of increase of about +6%/year, which would double their consumption in 12 years.

If there is such an article, and people believe it, what happens then? Goodbye to the world as we know it.

check out the WSJ website.

Well done! Wish I could read the rest... If anyone finds a source...

This wipes the lipstick right off the pig. Exports are declining at 2.5%? That cannot but accelerate minus major behavioral changes or magic, one or the other. The reality of the ELM = Peak Oil for net importers. It's as simple as that. Non-OPEC production was flat and/or falling before Russia started their nosedive. So, if the export trend is irreversible, so is Peak Lite. Or ELM-iPL: ExportLand Model-induced Peak Lite.

Welcome to the beginning of the end of the Oil Age.

Cheers

WSJ heh

well done

Boris

London

That Russia graph helped me put this in perspective. Russia has been responsible for between 570,000 and 660,000 barrels a year in new production the last six or seven years. Plus new Russian decline... Even 1% a year is another @ 100,000... Lordy... That's a change of -650k to -750k barrels a year...We're going to be looking at a million barrels a day less from Russia alone within a year or two.

And Mexico is dropping double digits a year...

But prices have nothing to do with decline...

People keep saying that but I don't see it in the graphs (as here). Is it based on some inside info instead?

Chart 69 shows 6 months of falling Russian production at a time of record prices. But true, this is not enough to call a second peak. From memory, Campbell, Laherrere, Duncan and Youngquist all have Russia hitting a second peak around now based on what they have already produced compared with their reserves. If Russia continues to fall for another 6 months then we may all be in very serious trouble.

Aha, I hadn't noticed chart 69! (I guess my IQ of 180 has become an Idiocy Quotient instead.) Thanks for the clarification.

http://www.tehrantimes.com/index_View.asp?code=169989

Russian oil exports fall 4.9% year over year

Our middle case has Russia approaching zero net oil exports in about 16 years.

Very good article. I think that a lot of the delusional thinking going on can be attributed to the manure being dumped on the public by ExxonMobil, Saudi Aramco/OPEC and CERA, et al, to-wit, that we don't have to worry about Peak Oil for decades--worst case.

Judging by his piece in the Financial Times today, Yergin has recently seen the light on the Road to Damascus.

A lot of what he was saying appeared to have been cut-and-pasted from Matt Simmons' publicity materials.

He even mentioned a study that CERA is supposed to have carried out two years ago on the likely effects of $150 barrel oil....

That was news to me and I suspect others here as well.

Does anyone know anything about that report, or was it just in-house ?

I'll repeat a "hypothetical" question I posed a few days ago. What if a journalist was asking hard questions about Yergin's price predictions, possibly with an article in mind on his numerous failed predictions? How would Danny boy react?

We can't save people who don't want to be saved. Unfortunately they will drag us with them. Attempts to make the media see the light are vanity, don't you think? Has anyone ever succeeded? What master do THEY serve? The consumption industry and they're not about to shoot the golden goose.

Today's (Saturday's) Independent devoted its front page to the decline of oil supply. Followed by three pages of reports and an editorial making clear it was due to peaking supply and we had to reduce dependency rather than cut taxes.

A week or two earlier their front page was "Are we running on empty?" followed by articles of wishfulthinking. A year or two back the Independent (again) had a similar shocking front page, but when I pointed it out to others in Tesco their brains just glazed over.

Today in the shop where I saw the Indy headline, no-one was taking the slightest notice of it. And outside I chatted with an intelligent man who remained absolutely convinced that some new techno-solution, some new source of energy would certainly be found in time and the city's grand redevelopment plans would come to pass.

I don't think it's a media/forces-of-darkness coverup. Rather it is just the eternal Noah's Ark syndrome. The Forces of Darkness are no less insane on this. They have the most to lose and so the stronger the psychodenial.

Thought you were "sworn to secrecy"? i would recommend not divulging anything beforehand.

I'm not naming names (I'm also talking about two different articles).

Unfortunately, the press still takes Yergin at his word. Now he says that in 2006 he came up with a scenario identical to what's happening. This of course is while he and CERA were predicting price declines.

"In 2006, when prices were about $US70 a barrel and temporarily falling, he developed a scenario in which they peaked at $US150 a barrel, bringing about the world's "fourth oil shock". While that was more a projection of what could happen rather than a prediction, events so far have largely followed the script."

Yergin does some CYA

The press has a new CERA:

"Now for the good news. This week, Australian Bureau of Agriculture and Resource Economics executive director Phillip Glyde said oil prices should ease during the next few years as non-Organisation of the Petroleum Exporting Countries supply increased and the growth in demand for oil slowed. ABARE's forecast in March was for prices to fall to $US67 ($70) a barrel during the next five years, although Glyde added this could change the next time the bureau looked at the figures."

Would this be the same ABARE that assumed for their forecasting back in 2001 that, for the period out to 2019-20, the price of black coal would continue to fall by 1.5% per year and that oil would continue to trade at US$23 per barrel?

It is galling to see this change in position and rewriting of history. These people have no shame.

where is the "we got it wrong.. very wrong" its not that difficult to say or humiliating if you think about it.

integrity is everything.. and I say that despite failing on many an occasion myself... but I know from experience I regret not sticking to the path of truth in hindsight.

you bright lads and laddettes at TOD need to steep up your game and seize a bigger share of the mantle

Boris

London

Could it be that the price for a barrel of oil should still not be as high as it is now. See here:

http://globaleconomicanalysis.blogspot.com/2008/05/quantifying-commoditi...

...then here:

http://globaleconomicanalysis.blogspot.com/2008/05/commodities-speculati...

I get more and more confused about the roll of speculation, and wonder if it doesn't have a larger impact on oil prices than discussed here.

I love Mish, but I'm not sure what he's actually trying to say in those posts.

I found this argument on spec and price between Rick Santelli and others on CNBC to be pretty informative: http://www.cnbc.com/id/15840232?video=753754816&play=1

It was discussed in yesterday's DB if you wish to see what others thought.

By the way, this is a great piece Euan.

Normally, Mish leans more toward peak oil, with a speculation subset, so his conclusions (if they were conclusions) have left me baffled. (Another thought was: If we have this type of speculation, and we stop it in its tracks, won't the price runups that the speculators caused lead to a collapse in those prices, at least in the near term?)

It would be nice if a financial news show, which just had two guests debating whether oil has to be delivered when a futures contract expires, would have a follow-up and give the correct answer. But it seems that in order to keep their talking heads happy, the shows that feature them never try and settle the disagreements.

Celticoil - the way I look at it is if oil had been below $50 for the last few years, demand would likely be a couple of million barrels per day higher than now. So the question is would the production be there to satisfy that demand given lower prices?

I believe not, and high prices are destroying demand on a daily basis - which has now got the attention of the politicians and media. For so long as The Economy holds together I also think that demand destruction will place a floor under the oil price since those priced out of the market already will take the opportunity to snap up that bargain barrel when it is available.

Speculators I suspect lie behind some of the short term volatility we see, such as today where the oil price has gone from $128.9 to $129.9 via $126

Thank you for your insights. We have logicalities leaping all over the place, the problem is grabbing the right logic!

The only logic that really needs to grabbed hold of is that we live on a finite world and infinite growthh is impossible in a finite system. There is only so much stuff be that oil, water, iron, land for agriculture, space for windmills, whatever. Eventually, we're going to hit a wall in our expansion.

Here's an example in China of unfulfilled demand.

http://cryptome.org/cn-fuel-low/cn-fuel-low.htm

He claims "All cities of China are like that".

It's just like the 70's... Now, just imagine the Chevelle's, El-Caminos and Lincoln Continentals in line instead of the subcompacts of today.

Oh, and this is a scene that will come to a pump near you within the next few years...

It's just like the 70's... Now, just imagine the Chevelle's, El-Caminos and Lincoln Continentals in line instead of the subcompacts of today.

Oh, and this is a scene that will come to a pump near you within the next few years...

Faith Birol has stated that there is a 12.5 mbpd shortfall between where we are now and where we should be in terms of oil production. The Energy Bulletin had an English translation of this article but removed it, with a promise of an authorized English language translation. No such translation has yet appeared.

Unauthorized translations do exist at multiple websites though:

International Energy Agency admits to 12.5 million barrel per day ...

Chief International Energy Agency ( IEA ) Economist Fatih Birol ...

Fatih Birol interview: 'Leave oil before it leaves us ...

I'm going out on a limb here, but what the hell! I think the price of oil and all energy sources are not now reflecting true costs. I claim that oil prices should be, and will be soon, higher still. The reason is fundamental physics - net energy. It takes time for the impact of declining EROEI to propagate through the economy and feed back to the various cost inputs to oil extraction, shipment, and refining. Rising energy prices always reflect in general inflation. Meaning that the cost of oil rigs, pipelines, transportation, and refining are all going up eventually, thus recursively adding to the base costs. Eventually this has to work its way into the price of oil and the vicious cycle continues.

There is no way to go but down (the economy) while under our current way of accounting for things. Money is sort of a free-floating means of measuring. A more physically realistic method would be to account for everything in BTUs (or make a dollar worth a given number of energy/work units). This would expose the feedback loop explicitly. It would put an end to all the silly speculation about what the reasons are for oil prices being this high.

See my discussion of an energy-based standard for currency at:

Question Everything

George

George,

The energy theory of value has been around for quite a while.

Check out the Technocracy Movement.

They still maintain a web site: http://www.technocracy.org/

Take a look at who provided some of the intellectual underpinnings, King Hubbert!

Some of his writings might interest you.

E. Swanson

Thanks BD.

I didn't know these guys were still in business! I wandered into a Technocracy office in Seattle back in the early '70s when I was a junior at U. Wash. in Seattle. I thought their program and ideas sounded cool. I remember getting into a long discussion with several of the members manning the office about energy. At that time they were advocating damming every conceivable river in the US! I had just written my first attempt at reconciling economics with physics via the relationship between money currency and 'free' energy (the energy available for work in any potential source). The paper was for an econ course (the TA who graded it gave me an A for original thought - the professor later downgraded it to a C since I clearly did not understand economics!)

I don't remember the Technocrat folks talking about energy accounting, but maybe they were using different terminology back then. In any case we had a great talk, but I was not completely happy with what seemed to me to be a total faith in science - what we would call scientism. I thought they might be clutching at straws and I wasn't clear on what the political implications were. They seemed to think a panel of scientists and engineers would 'rule' the land. I didn't so much mind that idea, I just thought it was naive given the general mass stupidity of the electorate (I could not have then imagined it getting as bad as it has).

Anyway, from a quick perusal of the Wikipedia article it looks like they have kept the faith, but updated some of their thoughts about how it will play out. Thanks again for the alert. I will try to dig into their energy accounting methodology to see if it comports with, say, some of the tenets of ecological economics, which is very much nearer to where I am.

George

George

The reason is fundamental physics - net energy. It takes time for the impact of declining EROEI to propagate through the economy and feed back to the various cost inputs to oil extraction, shipment, and refining.

It's like a freight train starting up, as each car starts moving, it picks up some slack at each car, eventually the whole train is moving. Each car makes a loud CRACK sound as the slack is taken up.

What you discribe is the financial equilvant. The CRACKing sound is people out of work, businesses closing etc of the costs makeing their way thru the system. Taking up whatever slack there is.

But this train is moving now, and picking up speed AND Momentum.

Dow Chemical's 20% increase across the board is another loud CRACK of slack being taken up and Financial Adjustments that causes thoughout the whole train. Speed is increasing the adjustments and it is now all in a feedback loop.

This is an elegant analogy, especially if you are a train buff like me!

I agree that the "bidding up" of commodities is responsible most of the recent drastic increase in the price of oil (i.e., price increase from $100 to $130/bbl) and is caused by the very weak dollar. Why I believe this is that the price of gold, food and other commodities have increased dramatically too - nearly lockstep with oil. If these other commodities increased a much smaller amount, then I would have thought that the price increase is solely caused by a crude oil supply shortfall.

The other reason why I believe that the price of crude oil is being driven by commodity trading is that crude oil stocks are not suffering. The U.S. crude oil stocks as well as those for the OECD are well supplied. I suspect that when the Fed starts increasing interest rates again, that the price of crude oil will drop back down to around $100/bbl.

One question I have about the calculation of depletion. Does the 4.5% depletion apply to just crude oil production, crude oil plus condensate, or to total liquids as you have applied them? It seems that CERA would only account for depletion in crude oil production, or perhaps to C+C, but probably not nonconventional oil and certainly not biofuels, but they could be calculating the figure that way.

Retsel

Use the "share this" applet to reddit, digg, and send this post to other sites.

Thanks.

PGoose: Can I suggest that you do a key post on how to do this, just to educate everyone? Yesterday I signed up to reddit and was staggered at how easy the process is of joining and voting. It then got me wondering - surely you must be able to marshall 100-200 readers on here to vote for every article you publish? I had never bothered to figure out how to do it until now, and it really is so absurdly easy.

*sigh* I've done it probably six or seven times over the past year...honestly, I think it's just hard for people to remember to do.

I have to say it PG, I don't like hearing you say *sigh*.

As I see it, TOD has 2 main purposes. The first is to provide information about Peak Oil, and allow discussion about it. It does this very well. Without it there would only be LATOC and PO.com, which serve different niches.

The second purpose is to get Peak Oil into the limelight. Unfortunately, as a person who has been PO aware since early 2005, I have seen the alternative media have zero success thus far penetrating the MSM. Increased coverage of Peak Oil in the MSM in recent weeks is completely due to the once unthinkable price that oil has ascended to.

PeakOil.com recently made a bit of a breakthrough. They are in the lead now. What are you gonna do about it? Keep asking and pleading? Or is it time to pull out your inner Caesar :)

If you're having trouble with the 'Share This' option:

http://reddit.com/info/6l55e

http://digg.com/world_news/Why_oil_costs_over_120_per_barrel

Another couple of charts I made. Not entirely sure what they mean yet. The top one picks out quite clearly two separate trends with the dog leg in 2004 when OPEC spare capacity went to zero.

The second shows a possible roll over in production (too early to say yet) but whenever we see production falling and prices rising sharply I'm pretty sure we will be past peak. In the past, a fall in production has often signaled soft demand and OPEC holding back and normally correlates with soft price. So production falling and price rising is one of my litmus tests for peak.

Euan, Very good summary. Have you created any charts taking into account the lower energy content of the unconventional liquids as reduced barrels equivalent, as you noted? It should make the above chart curve downward earlier and more sharply.

Fantastic article, Euan! You did an amazing job capturing the world's oil realities in the current age.

I'd like to reply to both your article and the graphs you posted above.

First the graphs...

This rapid increase in price coupled with falling world production in March and April was very concerning to me. It has looked like the peak oil scenario you noted above and, if it continues, seems the megaprojects are failing in a big way and trouble may be a bit nearer than new projects would indicate.

Megaprojects caverats...

When you consider that nearly 3 million barrels per day of the 7 million barrels per day of megaproject oil is supposed to come from Saudi Arabia (struggling to maintain production), Russia (in decline since October), Mexico (in unbroken decline for a number of years now), and Nigeria (in political turmoil), things don't look so rosy for increasing production against an approximate 3.8 million barrel per day decline rate.

A fun little thought experiment is matching the 4.5 percent decline rate to Russia, Saudi, and Mexico and adding in the projected megaprojects increases. The net result would be approx 200,000 bpd in new Russian oil, approx 700,000 barrels per day in new Saudi oil, and approximately 300,000 barrels per day in added Mexican oil. So far, this simply isn't happening.

Political unrest...

As for Nigeria, I wonder how any kind of increase can be factored in when the infrastructure needed to support increases is under constant assault. Oil infrastructure is very vulnerable to military attack and its geographic distribution makes it a nightmare to patrol and protect. Until the political environment in Nigeria changes, I would count it out of expanding production in any significant way.

Iraq, responsible for approx 900,000 barrels per day in megaprojects through the end of 2009, suffers similar potential trouble with instability both threatening current production as well as putting at risk any possible expansion. More recent stability in Iraq is encouraging. But it's difficult to count on the situation remaining stable given the current political environment.

In the end, you just have to wonder if the entire megaprojects summary for 2008 represents a paper tiger?

Demand destruction finally takes a bite...

Did you see the recent reports on US oil demand falling by 900,000 barrels per day year on year in the first quarter of 08? This 4 percent or more decline in the US market is likely due to economic contraction in the auto (less driving and new SUV purchases), trucking (less trucks more trains), and air industries (massive cuts in flights/routes) as well as increasing efficiencies -- more small car/hybrid/motorcycle/scooter purchases, more people walking, biking, or taking public transport, shift to trains, and airlines purchasing or making use of more efficient air transport where possible.

What is yet to be seen is to what degree demand destruction in the US impacts economies exporting goods to the US market -- primarily China/India. If the impact is great enough, it is possible we could finally see curbing growth or even flattening in these regions.

Jeffrey Brown's Export Land Model...

is waiting in the wings and about to take center stage. Add the reduced energy of oil substitutes and the net effect is Peak Oil light even at plateau in world production. I'll be very interested to see the MSM report on ELM related issues. Please post it here in flying colors when it comes out!

Conclusion -- Oil Price Fights Demand for production capacity

Seems that the enviroment of demand destruction is finally here. So the world now has an effective means to fight high prices -- pain = less use of oil.

Out of this environment, the factors become a bit more complex.

1.Constrained total world production pushes prices higher

2.Reduced world exports pushes prices higher

3.New energy sources have a mitigating effect on high prices but are not a panacea

4. People use less oil, purchase more efficient machinery, and attempt to shift to non-oil based transport wherever possible.

5. Raging world oil demand becomes anemic world oil demand. Areas of rising demand include Middle East, Russia, China, India. Areas of falling demand include the OECD and the US.

So at what price does demand go to flat or falling? At what point does reduced demand reduce prices? At what price does the current market reach a balance? Will high prices ever result in significant new supply/substitutes? And at what point does constrained and/or dwindling supply push the price yet higher?

I think the above is the cycle we're seeing develop within the markets. It's a little different than raging demand hits a supply wall, pushing prices higher. Here the primary forces are supply constraint and demand destruction. Most economists have nightmares about this kind of scenario. But here we sit.

Back of the napkin new oil price bottom: $90 per barrel.

Back of the napkin new price ceiling: $160 per barrel.

Back of the napkin peak liquids top of curve (bumpy plateau): 2005 -- 2012.

Back of the napkin estimated dates for start of gentle decline: 2008 to 2009.

Back of the napkin estimated date for start of hard decline: Sometime around 2012.

ELM date for start of net decline in world oil exports (Jeffrey Brown is the ELM guru. Jeffrey please correct me if I spread disinformation!): 2005.

One final point to make. With credit in trouble, real estate values falling, and banks at risk, there is less money out there chasing more expensive goods. This is different from the cycle of stagflation where more, rapidly devalued, money chases scarce goods. So in a very weird event, oil prices may fall marginally even as the purchasing power of consumers dwindles by a greater degree. Not deflation. Not stagflation. But conflation.

Robert - thanks for you thoughtful comment. No doubt we have significant demand destruction now. I suspect this started among poor folks / countries back in 2002 and began to bite 2004 and now OECD middle classes are beginning to feel the pinch.

So yes we will start to conserve and be more efficient. I think there is a version of Jevon's paradox that we don't yet understand in this environment which is that energy efficiency cannot lead to greater consumption but will instead lead to higher prices. If we all drive cars that do 60 mpgs then we can afford to pay twice as much for the fuel.

As for your back of napkin estimates. I stick with my 2012±3 years for all liquids peak - this will need the confluence of a few mega projects all coming on together! And I see the ceiling and floor a bit higher than you - $110 to $180 - but this is based just on gut feel.

Hard decline is the scary issue which I have until now placed at the back of my mind. But we need to be concerned that we may be on the cusp of hard decline in exports.

"If we all drive cars that do 60 mpgs then we can afford to pay twice as much for the fuel."

Sure. Similarly, we're willing to pay a great deal for diamonds, because we buy very, very few of them.

PHEV's and EV's are now cheaper than ICE's (with large volume production, which is coming in the next 2-3 years) - we're on the cusp of a whole new type of transportation.

Nick, how are you figuring the statement that they are cheaper than ICE's?

Is that counting fuel costs?

What assumptions are you making for the type of vehicle, range etc?

Not that I would disagree that it may be possible, particularly for EVs, but I would be interested in how youa re running the figures.

"how are you figuring the statement that they are cheaper than ICE's?"

Ok, here goes.

First, let's simplify, and assume we simply add additional battery capacity to a Prius (and a plug, which is trivial). I would argue that a serial hybrid (like the Chevy Volt) is less complex than a parallel (and therefore less expensive in large, mature volumes), but that's not necessary to demonstrate the point.

OK, at 45MPG and $3/gallon, a Prius costs 6.7 cents/mile.

Now, good quality cobalt-based small-format batteries, as used in the Tesla, cost $400/KWH. Iron-phosphate is less expensive, and large formats are less expensive. The plug-in Prius is planned by Toyota for 2 years from now, which gives us another 2 years of the normal 8-10% annual cost reduction seen with li-ion's. Large scale PHEV battery production will instantly raise the volume of production for these 2nd generation li-ions to very large levels compared to conventional li-ion, reducing costs further. That gives us a reasonable forecast of $300/KWH (if this seems too aggressive, perhaps you'll grant that this is very likely several years later, when PHEV's have gone beyond early adopters, are ramping up to much higher production volumes, and batteries are that much more mature).

A123system's batteries can handle 5,000 discharges at 100% depth of discharge. If we assume 250 per year we have a battery that will last the life of the car. At a 10:1 capitalization rate (to account for interest, depreciation and obsolescence), we're paying $30/KWH per year, for 250 discharges, or $.12 per KWH discharged.

At .25kwh/mile, that's $.03 per mile, less than half the Prius cost. If we double the battery size to account for GM's conservative decision to only use 50% of the battery capacity (this is similar to the Prius, and almost certainly unnecessary, but GM's taking no chances at all), we're still at $.06/mile.

Now, charging will be done almost exclusively at night. Utilities are required to offer time-of-use power pricing by the 2005 energy statue, but many don't publicize it. OTOH, PG&E, SCE and Exelon are pushing it. PGE&E's night time pricing (like most CA electricity) is more expensive, starting at $.08/KWH, OTOH gas is also more expensive there.

So, add $.04/KWH for night time electricity (and 4 KWH/mile) for a cost of $.01/mile for power, and we're at $.07/mile, or rough parity.

Of course, taxi's and other fleet operators are likely to recharge more than 250 times per year, dramatically raising payback. For the average driver, add in CO2 costs, and other external intangibles like independence from the ME, and the ability to weather gas shortages and you have a compelling case.

And that assumes $3 gas, and a Prius as a benchmark - $4 gas, and a 22MPG vehicle (the US average) would make the case that much more compelling.

---------------------------------------

Hence my original point - light vehicles are going to change dramatically.

Electrification of light vehicle transportation is cost-effective at $1.75/gallon (for conventional lead-acid batteries) and at $3/gallon for more convenient li-ion batteries, but electric vehicles (either PHEV's or EV's) faced serious barriers to entry in the form of very large investments (capital, emotional, career, etc, etc).

This period of prolonged high oil prices will provide the impetus to push through this barrier. Once the barrier is crossed, costs will come down due to economy of scale, and PHEV/EV's will be forever entrenched. They are likely to follow ever falling cost curves, and largely replace fuel-based transportation.

How this will play out for the whole world (and overall depletion curves) is a tough question, as the US is the clear leader in adoption of hybrids, PHEV's and EV's (Japan sells them, and China is developing PHEVs and EVs), but I see fundamental change ahead for the US.

___________________________

You might ask "What about the cost of converting a car from ICE to battery?"

Here we don't have OEM vehicles and batteries, with large production volumes. Conversions are more expensive, both because of the inefficiency of retrofits, and the much higher cost of batteries at retail which weren't really designed for the purpose.

Tesla is, of course, buying in fairly large volume. They don't promise more than 500 deep discharge cycles (though they're clearly hoping for substantially more).

A123systems batteries have good specs and are fairly widely available, but not in large formats - these are reserved for large buyers like GM, at the moment. Hobbyists are using them for motorcycles (Killacycle) and bicycles, and A123systems offers a pricey Prius conversion. Retail prices are a bit high for a 10 KWH conversion at this point, in my view, but it's doable.

Your best bet for a car conversion (which can handle weight better than a bike) might be lead-acid (though they'll likely give less acceleration, and be less convenient weight and volume-wise). You could use Trojan T-105's - they would cost roughly $800 for 10KWH, and give you roughly 3-400 deep discharge cycles: that's about 20 cents per KWH-discharge, or 5-8 cents per mile. That's roughly comparable to a 30MPG car with $2 gas.

I'd also look into Firefly Energies: they don't seem to be available to consumers yet (they're selling to Husqvarna and truckers), but it should be very soon. They should offer 4-5 times better cycle life and better power density vs conventional SLA, at roughly twice the price, so the cost/KWH should roughly drop in half.

I like that- those costings are very conservative.

Toyota may not be wedded to over-specifying in the same way as GM, and anyway if they decided to use ultracapacitors they could safeguard against deep discharge more easily.

GM has recently affirmed that they are hoping to come in at the original $30k estimate, although they appear to be counting in a $7k tax rebate they are angling for, but just the same that is way better than the circa $48k they were recently saying they might have to charge, and the new cost estimates seem to be due to improved forecasts of battery costs.

There is also 'wriggle room' in that lead acid batteries with ultra-capacitors could be used, possibly by Chinese manufacturers, with much better cost efficiency.

I am not sure how long the US will be the market leader, as both Denmark and Israel in combination with Renault-Nissan are installing power points and battery changing systems throughout their small countries, and EV vehicles are far simpler than plug-in hybrids.

I think it will be awhile before it is worth considering converting my car to electric in the UK, as the government seems to have decided to hold down household expenditure on energy by the simple expedient of not having any available.

An electric bike is a possibility, providing it is foldable, but the theft rate of them will be enormous.

"I am not sure how long the US will be the market leader"

It's very hard to forecast. The more difficult question is poorer customers in developed countries, and poorer areas like India, Africa and S. America, which rely on older vehicles (and, in the case of SA, has traditionally imported used cars from the US), so new electric vehicles may take a while to get to them them. India and China at least have strong high-tech sectors. Poorer customers in the US may have to rely on carpooling and mass-transit for a while...

"that is way better than the circa $48k they were recently saying they might have to charge"

That was a mis-quote - the only other public comments GM has made was Lutz's comment a while ago that costs seemed to be rising closer to $40K than $30K. I think it's all really a question of how development costs are amortized, and how large an early-adopter premium GM thinks it can get away with (and, of course, the tax credit).

"An electric bike is a possibility, providing it is foldable, but the theft rate of them will be enormous."

A modest battery wouldn't be too expensive - do you think theft rates would be higher than for ICE motorized vehicles? I would note that electric bikes are almost certainly better cost and CO2 emissions-wise than person-powered bikes - retail food is expensive and high-emissions!

I was just basing my $48k figure on what a site I read yesterday said - doubtless it was in error.

On using electric vehicles in third world countries, in on of CNN's excellent Eco-solutions pieces they looked at Nepal, where there is a cottage industry to build electric taxis, which are very popular with the drivers even though somewhat more expensive than ICEs.

As long as you can get hold of the batteries and motors the fundamental simplicity of EV's seems well adapted to the Third world.

As for theft in the UK, bike thefts here are massive, and even chained up they have wheels parts stolen. Unlike cars, they can't be shut up.

Batteries would be a fine target, so the practicalities of ownership are rather difficult here.

My guess is that if running cars becomes impractical, large stores will go providing guarded storage for bikes whilst you shop.

"the fundamental simplicity of EV's seems well adapted to the Third world."

Makes sense - that's encouraging.

"As for theft in the UK, bike thefts here are massive, and even chained up they have wheels parts stolen. Unlike cars, they can't be shut up.""

Wow.

"shut up" means garaged?

"if running cars becomes impractical"

hmmm. Brings us back to finance questions, perhaps. I've a couple of thoughts on which I'd like to get feedback.

First, Alan mentioned the other day that France had a good balance of trade. I just accepted that, but I took a look later, and it looks to me like France has a 2.5% trade gap (of GDP), which is fairly large - mostly from energy.

2nd, let me repeat something I just posted elsewhere:

World financial stability and growth is really all a question of how well oil exporters recycle their petrodollars.

If they follow the example of Norway, and sterilize at least some of their oil money by buying and holding oil importer debt (like T-bills), global trade will do just fine. Debt will balloon, but it won't matter - oil importing countries can keep their economies afloat by using the borrowed money to reduce taxes. Eventually the debt would be used, when oil exporters ran out of oil exports.

If, on the other hand, they keep their current strategy of excessive domestic spending, and pursuit of illusory high returns (like through mortgages via Collateralized Debt Obligations, or commodities(!!)), they'll keep creating domestic inflation, asset bubbles, and world financial system instability.

By shut up I just mean locked up when it is in the street - car theft was huge here, but has somewhat decreased as security on cars has been improved.

Alan's information is old - they went through a major fitness program to get the Euro going, but are now much slacker, far behind Germany:

http://www.banque-france.fr/gb/publications/telechar/bulletin/130edito.pdf

I am not familiar with their budget deficit and so on - governments are now expert in hiding the true state of affairs, and researching them is a major undertaking.

I do not expect the Euro to survive - at least not with all present members.

Whatever the finances of France, the finances of places like Italy, Spain and Greece are quite shocking, and probably could not live in a united currency block with Germany and the Netherlands even without very high priced oil - look at the contribution of their tourist trade.

With different economies pulling in different directions, national responsibility for setting budgets and their deficits and without a large central taxation structure there is, in my view, simply no way that the Euro will go on.

To stay in a currency block with Germany France is likely to do whatever is needed, as they have in the past, even if it means a major recession.

They have inflated their economy too much, but it has good strengths.

On your second point, the likely trend in oil exporters seems to be something of a mix, with perhaps places like Kuwait prepared to use sensible measures, but many just intent on spending and partying in London until the money runs out.

I do not know enough to comment in any more detail.

It's from the Wiki page on the Volt, and refers to this article:

The road to higher auto-fuel economy - BusinessWeek.com- msnbc.com

Page 2:

In the News: Chevy Volt for under 30k? LOL if only.

Since it's looking like no one will ever drawn in the reins on oil price again, after five years of body blows to GDP I'd expect a more reasonable ceiling for the average ODEC citizen's transportation purchases to be more along the lines of $3K. Sic semper power windows!

Yes, and a direct followup question to GM found that Businessweek misquoted Lutz - see http://gm-volt.com/2008/04/28/how-much-will-the-chevy-volt-cost/ .

Any new, low-volume program should be expected to lose money in the first years - the Prius did. You have to absorb losses for several years before production volumes get high enough to bring down production costs - it's a chicken and egg problem.

Below $30K, 2.5 years from now, is right about the inflation-adjusted average price of $28K for new vehicles currently.

Great, we'll know the MSRP when it debuts - in Nov. 2010, in an avalanche of production:

That's your man Lutz talking, of course. Globe and Mail PHEVs will be fortunate to have a game to change in the first place; I'm betting on motorcycles, scooters and electric bikes to see us through peak oil.

Well, there's no question these things take time. OTOH, as people are fond of saying, it's hard to understand exponential functions: they start out slow, and pick up steam unexpectedly later.

In the next several years there will be a lot of PHEV/EV's introduced, including from GM, Toyota, Nissan, as well as smaller companies.

GM has made a point of saying that they accept Peak Oil, and that the Volt is central to their recovery and growth strategy.

The leaders in the EV revolution are likely to be the more dynamic countries in the Third World, for several reasons:

It is a lot easier to build EV vehicles on a small scale than ICE cars - they are not so complicated and lighter materials such as carbon fibre are preferable to metal, with it's heavy and expensive metal-bashing machines.

Producing the batteries and motors, tyres etc needs big business, but the assembly can be much more informal.

In this connection Western countries are at a great disadvantage for early adoption, since it takes years and many millions of dollars for type approval.

Further, for many in the Third world, the expectations are lower, since they are not moving down from an ICE but up to their first car, or more likely a covered trike, such as would not pass safety tests in the West.

Many of the electric bikes in China don't use the high performance lithium batteries, but manage with the much cheaper lead-acid, which in incarnations like the Firefly or lead-acid plus capacitor combination should in any case be able to give fairly decent performance for these very light vehicles, and in many areas such as India a PV roof to them would provide a useful supplement to the power on something so light.

In some developed countries other than the US conditions are also more favourable.

Switching their cars to EV, for instance, at least in energy generation terms, would be a trivial exercise for France, uniquely amongst countries, as they have excess nuclear power at off peak times already.

Doubtless they will build more nuclear to make up for expensive natural gas, but they are well set-up already.

These factors, together with the much shorter average distances travelled which make electric transport easier, likely mean that the US will be a laggard rather than a leader in EV adoption, with Japan, China, India, Indonesia and Europe moving faster.

Do we have any data on this? I haven't seen any good data. The US has a lot of small EV's, like golf-carts, which don't get much attention.

AFAIK, the US is in front on hybrids and PHEV's, and China is moving fast as well (China has a lot of electric bikes, as well). Europe is very slow on hybrids (in part due to a commitment to diesel), which is a convenient transitional form to PHEV's and EV's.

Safety regulations are a factor (GM has Volt prototypes running now, but it will take another 2.3 years to get to production, and probably at least 1 year is due to safety concerns), but I don't see that as making a big difference in the longer run - once the design is approved, it's just a matter of capex lags, which happen everywhere. Also, some developing countries have terrible bureaucracy - India, for instance, makes companies tear their hair out - I really wouldn't assume that India will be faster than the US.

The US and Europe have electrical grids that are more than adequate - not so much elsewhere (Japan's infrastructure is good, but their power costs are high, in part due to imported oil for generation).

My wild guess: I would think that the US, China and Japan would be in front, with Europe close behind and everyone else lagging a fair amount.

I haven't got any data, and in any case am not really sure what would be the best metric to measure.

As you say Europe has not been very dynamic in the EV and especially the PHEV car field, and has been distracted by hydrogen and fuel cells as well as diesel.

They are probably in a bit of a different position to the US though, as many of their small cars would make reasonably successful EVs anyway.

At least Peugeot has already got type approval for it's 106:

http://www.autobloggreen.com/2007/07/25/do-you-want-to-try-an-electric-c...

A lot of the existing fleet is also light enough so that a fairly good conversion could also be done if petrol goes through the roof.

Renault is also well advanced with plans for electric vehicles:

http://thefraserdomain.typepad.com/energy/2008/01/renault-nissan.html#more

Denmark will also have a 20,000 point recharging network:

http://www.msnbc.msn.com/id/23832749/

In Japan, I would argue that Toyota is by far the leader in hybrids, as the Volt is still on the drawing boards.

They are talking about a plug-in and if oil prices go higher I have no doubt that they will do so, and more confidence in their engineering than GM.

Mitsubishi is well advanced on electric cars:

http://www.popularmechanics.com/blogs/automotive_news/4255023.html

This is due out in 2009, well before the Volt.

http://techon.nikkeibp.co.jp/english/NEWS_EN/20080124/146156/

The higher price of electricity in Japan does not seem relevant to me since petrol is also very expensive, and the cost of the electricity for the car is trivial even at Japanese rates, especially considering the mow mileage the Japanese do.

They currently generate 40% of electricity with nuclear and plan to expand that - doubtless high oil costs will move these plans into high gear.

China is at the heart of battery production.

After the Olympics it seems likely that it will greatly reduce petrol subsidies. Little movement is perhaps to be expected immediately, as this should coincide with the onset of severe recession in the West, possibly restraining oil prices in combination with many countries reducing subsidies.

Fairly soon though, perhaps when the penny drops that oil is not going to get cheap, they are ideally placed to rapidly produce EV cars. trikes, and everything that moves.